No results found

We can’t find anything with that term at the moment, try searching something else.

Interest Calculator

With this free interest calculator you can compute accumulation schedules, final balances, and accrued interest.

Interest

End Balance: $135,479.01

After Inflation Adjustment: $100,809.11

Total Principal: $99,000.00

Total Interest: $39,224.74

Total Interest after Tax: $36,479.01

Initial investment

Interest after tax

Contributions

Tax

0 yr

5 yr

10 yr

| # | DEPOSIT | INTEREST | ENDING BALANCE |

|---|---|---|---|

| 1 | $32,400.00 | $1,486.44 | $33,886.44 |

| 2 | $7,400.00 | $1,908.58 | $43,195.01 |

| 3 | $7,400.00 | $2,350.77 | $52,945.78 |

| 4 | $7,400.00 | $2,813.97 | $63,159.75 |

| 5 | $7,400.00 | $3,299.17 | $73,858.93 |

| 6 | $7,400.00 | $3,807.43 | $85,066.35 |

| 7 | $7,400.00 | $4,339.82 | $96,806.18 |

| 8 | $7,400.00 | $4,897.51 | $109,103.69 |

| 9 | $7,400.00 | $5,481.69 | $121,985.38 |

| 10 | $7,400.00 | $6,093.62 | $135,479.01 |

| # | DEPOSIT | INTEREST | ENDING BALANCE | |

|---|---|---|---|---|

| 1 | $30,200.00 | $117.03 | $30,317.03 | |

| 2 | $200.00 | $118.25 | $30,635.28 | |

| 3 | $200.00 | $119.49 | $30,954.77 | |

| 4 | $200.00 | $120.72 | $31,275.49 | |

| 5 | $200.00 | $121.97 | $31,597.46 | |

| 6 | $200.00 | $123.22 | $31,920.67 | |

| 7 | $200.00 | $124.47 | $32,245.14 | |

| 8 | $200.00 | $125.72 | $32,570.87 | |

| 9 | $200.00 | $126.99 | $32,897.85 | |

| 10 | $200.00 | $128.25 | $33,226.11 | |

| 11 | $200.00 | $129.53 | $33,555.63 | |

| 12 | $200.00 | $130.80 | $33,886.44 | |

| Year 1 End | ||||

| 13 | $5,200.00 | $151.46 | $39,237.90 | |

| 14 | $200.00 | $152.82 | $39,590.72 | |

| 15 | $200.00 | $154.19 | $39,944.91 | |

| 16 | $200.00 | $155.56 | $40,300.47 | |

| 17 | $200.00 | $156.94 | $40,657.41 | |

| 18 | $200.00 | $158.32 | $41,015.73 | |

| 19 | $200.00 | $159.71 | $41,375.44 | |

| 20 | $200.00 | $161.10 | $41,736.55 | |

| 21 | $200.00 | $162.50 | $42,099.05 | |

| 22 | $200.00 | $163.91 | $42,462.96 | |

| 23 | $200.00 | $165.32 | $42,828.28 | |

| 24 | $200.00 | $166.73 | $43,195.01 | |

| Year 2 End | ||||

| 25 | $5,200.00 | $187.53 | $48,582.54 | |

| 26 | $200.00 | $189.03 | $48,971.57 | |

| 27 | $200.00 | $190.54 | $49,362.11 | |

| 28 | $200.00 | $192.05 | $49,754.17 | |

| 29 | $200.00 | $193.57 | $50,147.74 | |

| 30 | $200.00 | $195.10 | $50,542.84 | |

| 31 | $200.00 | $196.63 | $50,939.47 | |

| 32 | $200.00 | $198.17 | $51,337.63 | |

| 33 | $200.00 | $199.71 | $51,737.34 | |

| 34 | $200.00 | $201.26 | $52,138.60 | |

| 35 | $200.00 | $202.81 | $52,541.41 | |

| 36 | $200.00 | $204.37 | $52,945.78 | |

| Year 3 End | ||||

| 37 | $5,200.00 | $225.31 | $58,371.10 | |

| 38 | $200.00 | $226.96 | $58,798.06 | |

| 39 | $200.00 | $228.62 | $59,226.68 | |

| 40 | $200.00 | $230.28 | $59,656.96 | |

| 41 | $200.00 | $231.95 | $60,088.90 | |

| 42 | $200.00 | $233.62 | $60,522.52 | |

| 43 | $200.00 | $235.30 | $60,957.82 | |

| 44 | $200.00 | $236.99 | $61,394.81 | |

| 45 | $200.00 | $238.68 | $61,833.49 | |

| 46 | $200.00 | $240.38 | $62,273.87 | |

| 47 | $200.00 | $242.09 | $62,715.95 | |

| 48 | $200.00 | $243.80 | $63,159.75 | |

| Year 4 End | ||||

| 49 | $5,200.00 | $264.89 | $68,624.65 | |

| 50 | $200.00 | $266.70 | $69,091.34 | |

| 51 | $200.00 | $268.50 | $69,559.85 | |

| 52 | $200.00 | $270.32 | $70,030.17 | |

| 53 | $200.00 | $272.14 | $70,502.31 | |

| 54 | $200.00 | $273.97 | $70,976.28 | |

| 55 | $200.00 | $275.81 | $71,452.09 | |

| 56 | $200.00 | $277.65 | $71,929.74 | |

| 57 | $200.00 | $279.50 | $72,409.24 | |

| 58 | $200.00 | $281.36 | $72,890.60 | |

| 59 | $200.00 | $283.23 | $73,373.83 | |

| 60 | $200.00 | $285.10 | $73,858.93 | |

| Year 5 End | ||||

| 61 | $5,200.00 | $306.35 | $79,365.28 | |

| 62 | $200.00 | $308.32 | $79,873.60 | |

| 63 | $200.00 | $310.29 | $80,383.88 | |

| 64 | $200.00 | $312.26 | $80,896.14 | |

| 65 | $200.00 | $314.25 | $81,410.39 | |

| 66 | $200.00 | $316.24 | $81,926.63 | |

| 67 | $200.00 | $318.24 | $82,444.87 | |

| 68 | $200.00 | $320.25 | $82,965.12 | |

| 69 | $200.00 | $322.26 | $83,487.39 | |

| 70 | $200.00 | $324.29 | $84,011.67 | |

| 71 | $200.00 | $326.32 | $84,537.99 | |

| 72 | $200.00 | $328.36 | $85,066.35 | |

| Year 6 End | ||||

| 73 | $5,200.00 | $349.78 | $90,616.14 | |

| 74 | $200.00 | $351.91 | $91,168.05 | |

| 75 | $200.00 | $354.05 | $91,722.10 | |

| 76 | $200.00 | $356.20 | $92,278.30 | |

| 77 | $200.00 | $358.35 | $92,836.65 | |

| 78 | $200.00 | $360.52 | $93,397.17 | |

| 79 | $200.00 | $362.69 | $93,959.86 | |

| 80 | $200.00 | $364.87 | $94,524.73 | |

| 81 | $200.00 | $367.06 | $95,091.79 | |

| 82 | $200.00 | $369.26 | $95,661.04 | |

| 83 | $200.00 | $371.46 | $96,232.50 | |

| 84 | $200.00 | $373.68 | $96,806.18 | |

| Year 7 End | ||||

| 85 | $5,200.00 | $395.27 | $102,401.45 | |

| 86 | $200.00 | $397.58 | $102,999.03 | |

| 87 | $200.00 | $399.90 | $103,598.93 | |

| 88 | $200.00 | $402.22 | $104,201.15 | |

| 89 | $200.00 | $404.55 | $104,805.71 | |

| 90 | $200.00 | $406.90 | $105,412.60 | |

| 91 | $200.00 | $409.25 | $106,021.85 | |

| 92 | $200.00 | $411.61 | $106,633.46 | |

| 93 | $200.00 | $413.98 | $107,247.44 | |

| 94 | $200.00 | $416.36 | $107,863.80 | |

| 95 | $200.00 | $418.75 | $108,482.55 | |

| 96 | $200.00 | $421.14 | $109,103.69 | |

| Year 8 End | ||||

| 97 | $5,200.00 | $442.93 | $114,746.62 | |

| 98 | $200.00 | $445.42 | $115,392.04 | |

| 99 | $200.00 | $447.92 | $116,039.96 | |

| 100 | $200.00 | $450.43 | $116,690.39 | |

| 101 | $200.00 | $452.95 | $117,343.34 | |

| 102 | $200.00 | $455.48 | $117,998.82 | |

| 103 | $200.00 | $458.02 | $118,656.84 | |

| 104 | $200.00 | $460.57 | $119,317.41 | |

| 105 | $200.00 | $463.13 | $119,980.54 | |

| 106 | $200.00 | $465.70 | $120,646.24 | |

| 107 | $200.00 | $468.28 | $121,314.52 | |

| 108 | $200.00 | $470.87 | $121,985.38 | |

| Year 9 End | ||||

| 109 | $5,200.00 | $492.84 | $127,678.23 | |

| 110 | $200.00 | $495.53 | $128,373.76 | |

| 111 | $200.00 | $498.22 | $129,071.98 | |

| 112 | $200.00 | $500.93 | $129,772.91 | |

| 113 | $200.00 | $503.65 | $130,476.55 | |

| 114 | $200.00 | $506.37 | $131,182.92 | |

| 115 | $200.00 | $509.11 | $131,892.03 | |

| 116 | $200.00 | $511.86 | $132,603.89 | |

| 117 | $200.00 | $514.62 | $133,318.50 | |

| 118 | $200.00 | $517.38 | $134,035.89 | |

| 119 | $200.00 | $520.16 | $134,756.05 | |

| 120 | $200.00 | $522.95 | $135,479.01 | |

| Year 10 End | ||||

There was an error with your calculation.

Table of Contents

- Simple Interest

- Compound Interest

- The Rule of 72

- Fixed vs. Floating Interest Rate

- Contributions

- Tax Rate

- Inflation Rate

Fixed principal amounts and additional periodic contributions can be used in our Interest Calculator to compute interest payments and final balances. In addition to interest income tax and inflation, there are other considerations you can take into account.

Visit our Compound Interest Calculator to learn and compare different interest calculation methods.

Interest is the remuneration a borrower pays to a lender for using money in the form of interest or amount. The concept of interest underlies most financial instruments in the world.

Compound interest and simple interest are two separate ways of accruing interest.

Simple Interest

Basic examples of interest are shown below. Daniel wants to borrow $100 from the bank for one year (the “principal”). It costs him 10% in interest. To determine how much interest has been accrued, do the following:

$100 × 10% = $10

Daniel must pay back the loan’s principal plus interest after a year, which raises the total amount owed to the bank.

$100 + $10 = $110

After one year, Daniel owes the bank $110: $100 in principal and $10 in interest. Suppose Daniel wanted to borrow $100 not for one but two years and that the bank accrued interest each year. The interest rate would accrue twice at the end of the first year and the end of the second one.

$100 + $10(first year) + $10(second year) = $120

Daniel owes the bank $120 in principal and interest two years later. Apply the following formula to calculate simple interest:

Interest = Principal × Interest rate × Term

Use the formula when you want to calculate interest more often than once a month or once a day:

Interest = Principal × Interest rate × (Term / Frequency)

We rarely use simple interest in real life. Even in daily speech, the word ‘interest’ typically refers to compound interest.

Compound Interest

To explain compound interest, we need to take more than one period. Imagine we are looking at borrowing $100 for two years at a 10% interest rate. In the first year, interest is calculated as usual.

$100 × 10% = $10

When Daniel’s interest is added to his principal, he must pay back the bank for that period.

$100 + $10 = $110

But the year comes to a close, and a new one begins. Instead of the initial amount, we use the principal plus the interest accrued. If we consider Daniel’s situation:

$110 × 10% = $11

At the end of year two, Daniel’s interest charge is $11. Upon completion of the year, this amount applies to the balance owing:

$110 + $11 = $121

Suppose simple interest is used instead of compound interest. In that case, the bank would receive $120 from Daniel. With compound interest, Daniel should return $121 because interest accrued on the interest.

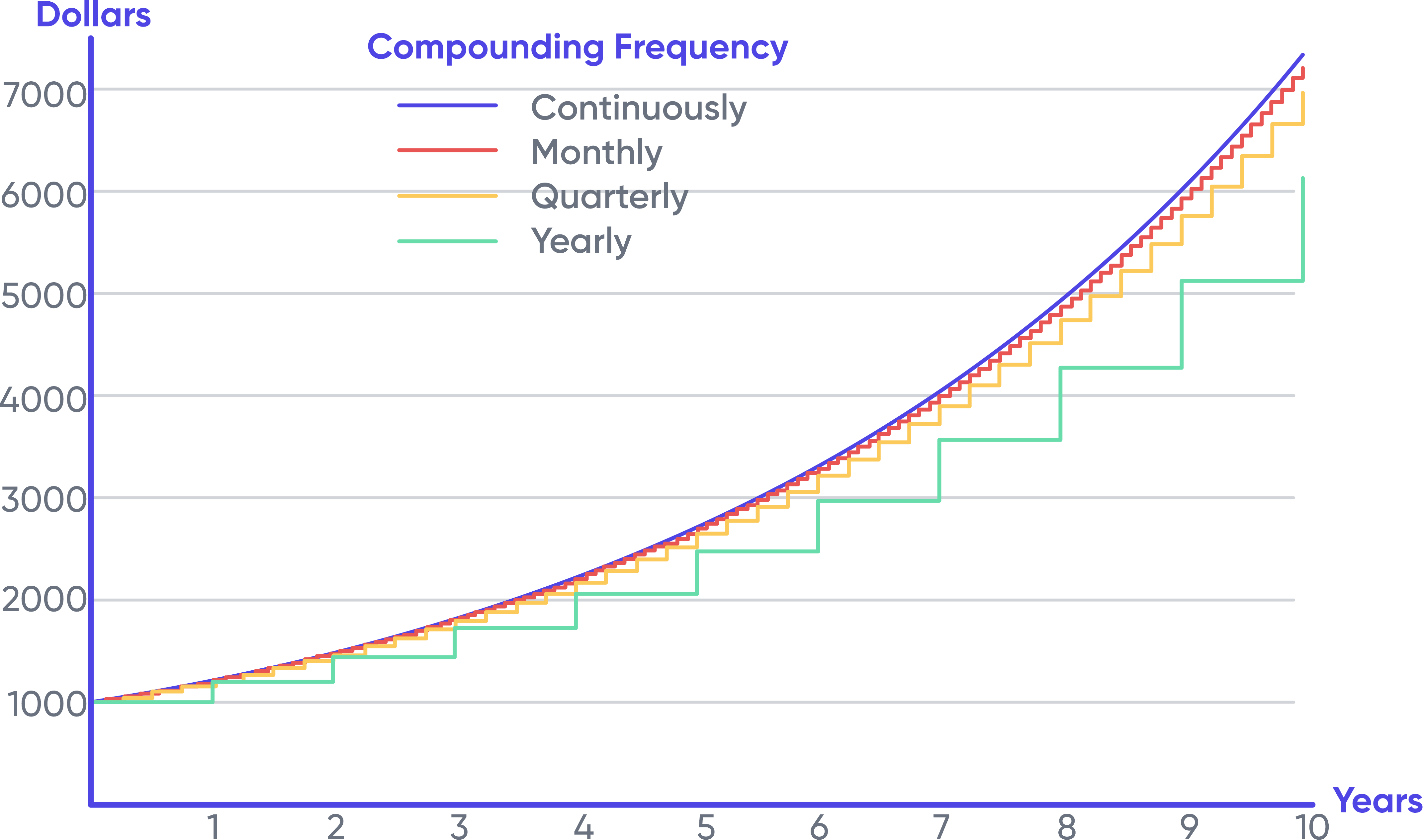

The more often interest accrues over time, the more interest will accrue on the original principal amount. Below is a chart showing how a $1,000 investment at various compounding frequencies earns 20% interest.

Initially, there is little difference in the frequencies, but they gradually become more distinct as time goes on. It’s a visual representation of the power of compound interest. The continuous compound will always yield the maximum return because of the mathematical restriction on how often compounding may occur in a given period.

The Rule of 72

The rule of 72 can come in handy for anyone who wishes to make an educated guess about compound interest. As financial calculators provide, you can understand the general range instead of getting specific numbers. Divide 72 by the interest rate to discover the number of years (n) it takes to double a specific amount of money (amount).

How long would it take, for example, for an investment of $1,000 to become $2,000 if the interest rate was 8%?

n = 72/8 = 9

Nine years would take you to turn $1,000 into $2,000 at 8% interest. This method works best for 6 to 10% interest rates, but it should also work immensely well for less than 20%.

Fixed vs. Floating Interest Rate

Fixed or floating interest rates might apply to a loan or savings account. In most cases, floating-rate loans and savings depend on a benchmark rate, such as the US Federal Reserve funds rate or the London Interbank Offered Rate (LIBOR) (London Interbank Offered Rate). The savings rate is typically lower than the reference rate, whereas the lending rate is higher. The bank makes a profit on the difference.

Interest rates between highly creditworthy banks are used to create LIBOR, a commercial rate. LIBOR and the Fed rate are both short-term interbank interest rates. The Fed rate is the Federal Reserve's primary tool to control the money supply in the United States economy.

Our Interest Calculator supports only fixed interest rates.

Contributions

Using the interest calculator above, you can regularly calculate deposits and contributions. This is useful for those who habitually set aside a certain amount periodically. An essential distinction concerning contributions is whether they occur at the beginning or the end of the compounding period. Periodic payments at the end have one percentage period less in total contributions.

Tax Rate

Some types of interest income are taxable, namely interest on bonds, savings and certificates of deposit (CDs). Corporate bonds are virtually always taxed in the United States. Some types are fully taxable, and others are partially taxable. Interest earned on the United States federal treasury bonds can be taxed nationally. But they are generally not taxed at the state and local government levels.

In the end, taxes can have a significant impact. After 20 years of saving $100, Daniel will have $1,060. And the taxes with interest rate of 6 percent will be equal to:

$100 × (1 + 6%)²⁰ = $100 × 3.2071 = $320.71

It is tax-free. However, Daniel will only have $239.78 if his marginal tax rate is 25% at the end of the year. The 25% tax rate is applied to each compounding period.

Inflation Rate

Inflation is described as a gradual increase in the price of goods and services. Ultimately, due to inflation, a fixed amount of money will cost relatively less in the future.

The average inflation rate in the United States for the previous 100 years has been around 3%. For comparison, the average annual rate of return of the S&P 500 index (Standard & Poor's) in the United States is about 10% over the same period.

Taxes and inflation make it challenging to increase money’s actual value. There is a marginal tax rate of roughly 25% for the middle class in the United States. The average inflation rate is 3%. Interest rates of 4% or higher are required to maintain the currency's value constant, which can be challenging.

You can find information about inflation in the Inflation Calculator section of our website. You can use our Interest Calculator to get generic results by leaving the inflation rate at 0.